Core Lending Engine

Core lending engine: modular, white-label technology, with fast and reliable credit scoring engine and 360 omnichannel capabilities, enabling lenders to offer any loan product.

Existing customer? Login

Core lending engine: modular, white-label technology, with fast and reliable credit scoring engine and 360 omnichannel capabilities, enabling lenders to offer any loan product.

Benefits

Trusted by Financial Institutions, Debt Collectors, Retail & eCommerce

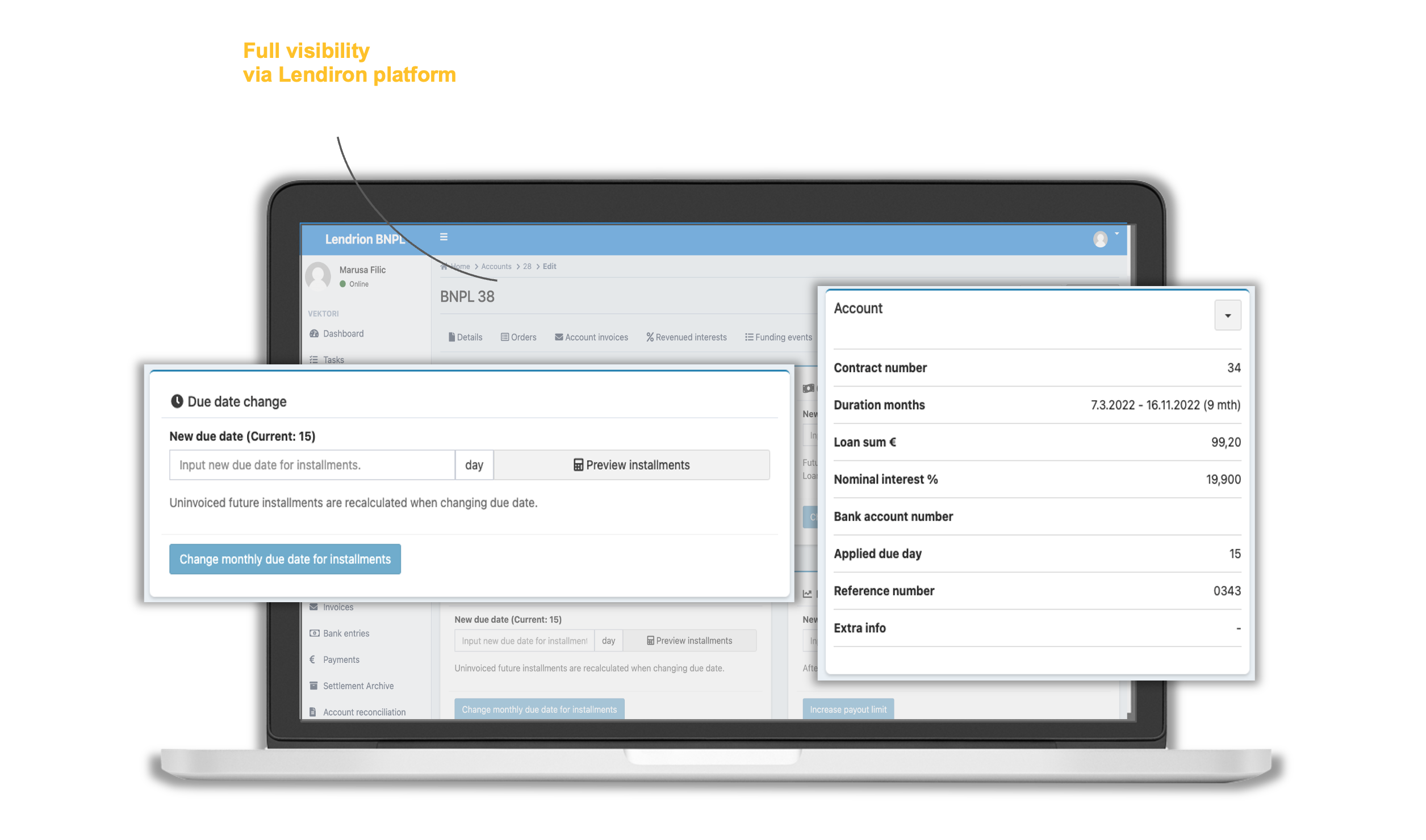

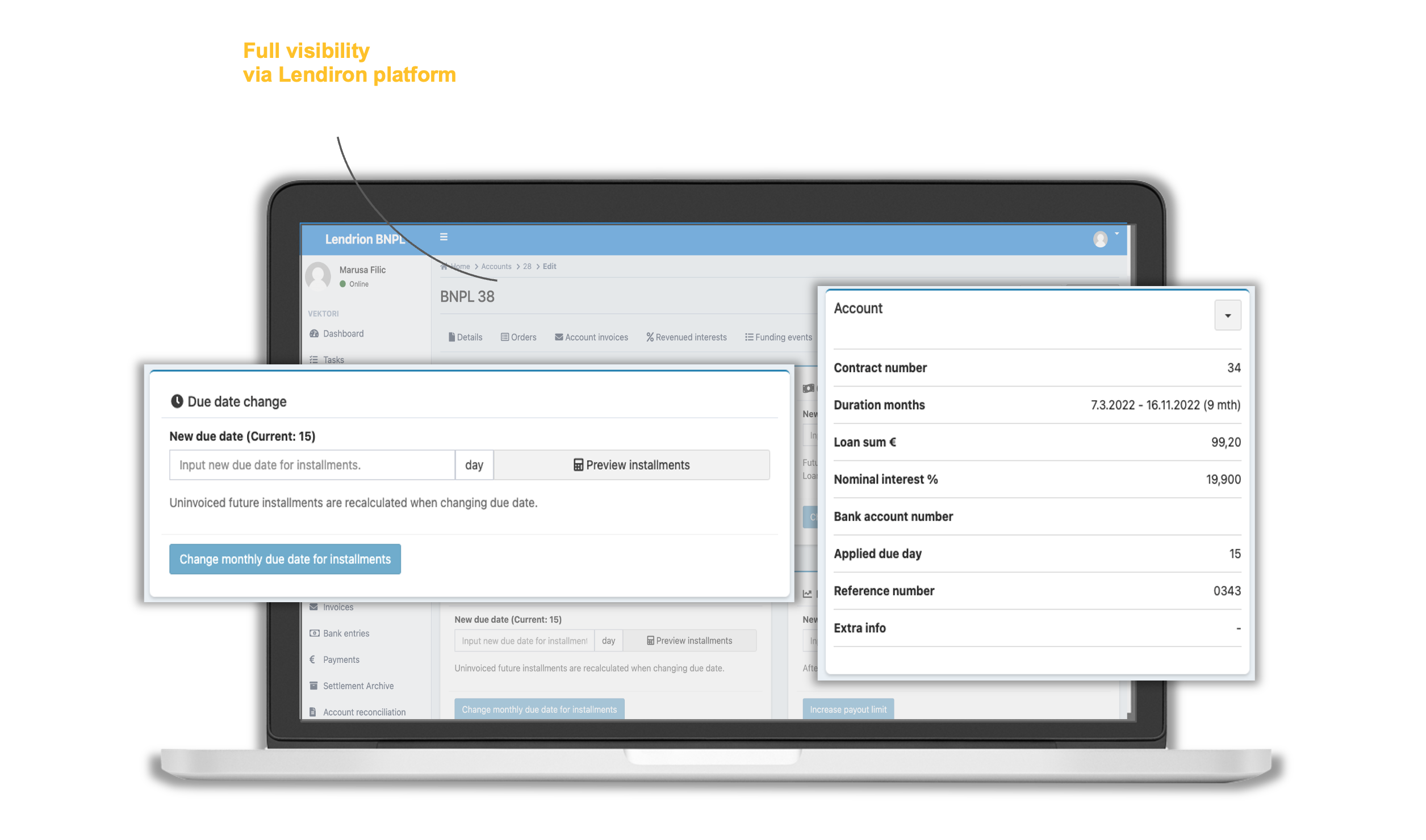

Reliable & Fast Loan Management System

Fast & Reliable Credit Decisions

HQ Visibility

Reducing Costs & Complexity

New Line Of Business

Main Features

Get to know about some of our outstanding functionalities.

Loan Application

Loan Origination

Payments

Invoicing

Authentication

Debt collection

Reconciliation

Online

Reporting and analytics

Partners, integrations and APIs